If you're considering transferring from Merrill Edge to Interactive Brokers, you're in the right place.

In this article, we will guide you through the process step by step, ensuring a smooth transition without the need to sell your stocks or ETFs.

It's important to be aware that Merrill Edge charges a $49.95 fee for a full transfer-out of your account to another broker.

Make sure you have sufficient funds or assets in your Merrill Edge account to cover this fee.

Check out my video on how to transfer your brokerage account below, let's dive in!

Interactive Brokers is a popular brokerage firm known for its advanced trading tools, a wide range of investment products, and competitive fees.

Whether you're an experienced trader or a novice investor, Interactive Brokers offers a platform with many options.

Learn more about Interactive Brokers here!

Robinhood is a popular "all-in-one" investing app.

While they are most well-known for their commission free stock trading, they've recently shaken up the Retirement Investing World too.

Introducing Robinhood Retirement; home of the biggest IRA match on the market.

Here's what you need to know:

And don't worry, this comes with a Portfolio Builder Tool. You don't have to construct your investment portfolio from scratch if you don't want to.

Lastly, you'll even get a free stock worth up to $200 when you open a new Robinhood account using our link.

If you don't already have an Interactive Brokers account, the first step is to open one.

Visit the Interactive Brokers website and follow their account opening process, which typically includes providing personal information.

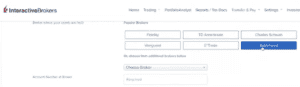

In the dropdown menu that appears under "Transfer & Pay," select "Transfer Positions."

This is the option you'll use to initiate the transfer of your assets from Merrill Edge.

In the next window, you'll see a list of popular brokers.

If you don't find Merrill Edge listed, use the drop-down menu to access more options.

You'll be prompted to input your account number from Merrill Edge, which can typically be found on your account statements or online account portal.

Ensure that the information is accurate to facilitate a seamless transfer.

Before finalizing the transfer, review all the details you've provided to ensure accuracy. Double-check your account numbers and contact information.

Once you're confident that all the information is correct, initiate the transfer.

Interactive Brokers will handle the process from here and keep you updated on the status of the transfer.