If you're considering investing in cryptocurrencies through platforms like Robinhood or Coinbase, you've landed in the right spot.

We're going to guide you through the essential features and differences between these two popular platforms, including their fee structures, the variety of assets available, any free bonus offers and more.

Let’s start out by explaining what these platforms are, and then we’ll dive into the side by side comparison of their offerings.

And be sure to check out my full video on Coinbase vs Robinhood below! Let's dive in.

Coinbase is an app solely used for trading, buying and selling cryptocurrencies. There are no stocks or ETFs available on this platform.

It is one of the most popular cryptocurrency platforms with over 108 million users and users can open accounts in over 100 different countries. There are also over 250 cryptocurrencies available on Coinbase to buy, sell, and trade.

Robinhood is a popular commission free stock trading app. While they got started with stocks and ETFs, Robinhood now offers options trading, futures contracts and more.

It also supports other assets like crypto and even options and futures trading with over 20 million users.

Robinhood is only available for US citizens and residents with a US address and Social Security number. So if you aren’t in the United States or don’t meet those requirements, you won’t be able to open an account.

If you open a Robinhood account using our link, you will get a free fractional share which ranges from $5 to $200 based on a random lottery system.

Even better, you actually get to choose your free stock from a list of 20 leading American companies.

Coinbase has a similar offer.

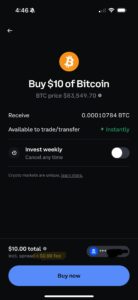

If you open a Coinbase account using our link, you will get a free Bitcoin Bonus. All you have to do is open an account and then complete your first crypto purchase of any amount. Then you get to Spin The Wheel for a free Bitcoin Bonus, which is valued between $3 and $200.

Just like the Robinhood bonus, it is a random lottery system. So whether you choose to go with Robinhood or Coinbase, you can get a free bonus.

There are some big differences between the assets available to trade on these two platforms.

As mentioned, Robinhood supports the trading of stocks, ETFs, Options, Futures contracts and more. But since Coinbase only supports crypto trading, we’re only going to focus on Robinhood’s crypto offerings.

So Coinbase offers about 10 times more variety of crypto assets, but that doesn’t automatically make it better. That is because we must consider the fees associated with trading cryptocurrencies on each platform.

Let’s begin with Robinhood, as their fee structure is a lot more straightforward.

Robinhood does not directly collect fees for crypto transactions outside of the normal network fees required for all crypto transactions. However, Robinhood does make money through something called Smart Exchange Routing, which is similar to Payment For Order Flow.

Basically, Robinhood earns a kickback for routing your trades to certain providers or market makers. So if you’re looking to trade major cryptocurrencies supported by Robinhood, you’ll most likely end up getting a better deal compared to Coinbase.

But if you want to trade a wider variety of cryptos, Coinbase could still be a great choice.

Coinbase also offers a premium feature called Coinbase One, which may appeal to some traders.

So let’s break down the different Coinbase Fees:

What about being able to send and receive crypto from your wallet?

In the past, Robinhood was criticized for not offering this functionality, but they have since added the feature.

With both Coinbase and Robinhood, you can send and receive cryptocurrencies. However, you might need to use the separate Robinhood Wallet and Coinbase Wallet apps for some tokens.

You can send cryptocurrency from Robinhood Wallet to any address or exchange that supports Ethereum, Bitcoin, Solana, Dogecoin, Arbitrum, Polygon, Optimism or Base transfers. Keep in mind, this list is subject to change.

There are also some key differences between the user interfaces for Coinbase and Robinhood.

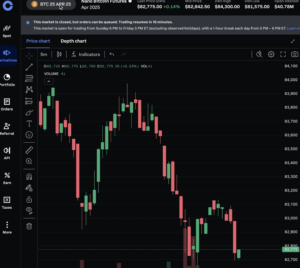

Coinbase provides two versions of their platform to use, the regular and the advanced version. Both versions come with no subscription cost, but provide very different features and experiences.

The regular version (shown above) of Coinbase offers basic charts for each cryptocurrency that show the coin’s value over a period of time. This version is easy for beginners to understand and use.

Coinbase Advanced (below) is a trading platform for experienced crypto traders, offering features like advanced charting tools, low volume-based fees, and access to various trading pairs.

Now, let's talk about Robinhood.

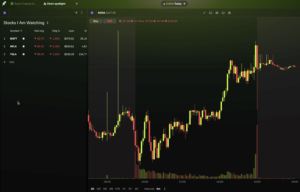

Robinhood offers crypto investing directly through the basic version of their app. In addition, they offer an advanced version of their platform called Robinhood Legend, which also comes with no subscription cost.

Robinhood Legend (shown above) allows users to view, chart, and trade select cryptocurrencies, with broader availability expected to be added soon. However, Robinhood Legend is mostly designed for active stock trading as opposed to cryptocurrencies.

Overall, if you use the basic versions of either app, most will find the experience to be fairly simple for beginners. But it’s great that there are more advanced tools available with both should you want those over time.

Both Robinhood and Coinbase are good choices for buying and selling cryptocurrencies.

Robinhood is great if you live in the US and want to trade popular cryptocurrencies with low fees.

Coinbase may be better if you want to trade lots of different cryptocurrencies or if you live outside the US.

Remember, no matter which one you choose, be careful when investing in crypto. It can be risky, and you should fully understand the risks involved before investing.