Dave is a digital banking platform that aims to help users improve their financial well-being.

It offers features such as budgeting tools, automated savings, and even provides cash advances to help users avoid overdraft fees.

Dave's primary goal is to assist individuals in better managing their money and achieving financial stability.

But one question remains; does Dave work with Zelle? We will be exploring that within this guide.

Zelle is a digital payment network that allows users to send and receive money quickly and securely.

In many cases, Zelle is directly integrated within mobile banking apps. But this isn't always the case, as not all banks are partnered with Zelle.

Zelle provides a convenient way to send money without the need for separate apps, cash or checks.

Be sure to check out my Zelle Tutorial below to learn how to use Zelle!

Dave is a fintech app designed to help users manage their finances and avoid overdraft fees.

Founded in 2017, Dave provides features such as budget tracking, spending predictions, and small cash advances to help users cover expenses until their next paycheck.

The app aims to prevent overdraft fees by alerting users of low balances and offering advances, which are repaid on the user's next payday without interest.

Additionally, Dave includes a side gig feature, helping users find part-time work to supplement their income.

If you're looking to send or receive money using your Dave account, one of the options you might be considering is Zelle.

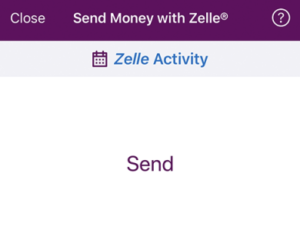

Unfortunately, Dave does not have direct integration with Zelle within its banking app. That means you won't find the option for Zelle within the app.

However, you can still use Zelle with your Dave account by using the alternative method of linking your account. Zelle has a separate app that allows users to enroll with a debit card - versus using Zelle within your banking app.

By using the debit card provided by Dave, users can link it to Zelle within the separate Zelle app (iPhone / Android).

To enroll with the Zelle app, users need to provide their basic contact information, including an email address and phone number.

By following these simple instructions, you'll be able to use Zelle with your Dave bank account.

Since Dave does not have direct integration with Zelle, users looking for fast and convenient ways to send or receive money may need to explore other options. Fortunately, there are several alternative peer-to-peer (P2P) payment platforms that work well with Dave’s banking services. Here are some of the best alternatives:

Cash App, developed by Block, Inc., is a popular P2P payment service that allows users to send and receive money instantly. It also offers a customizable debit card (Cash Card), the ability to buy and sell Bitcoin, and even supports direct deposit for paychecks.

Why It’s a Good Alternative:

Owned by PayPal, Venmo is another widely used payment app known for its social features, allowing users to add comments and emojis to transactions (although privacy settings can be adjusted). Venmo supports instant transfers to linked debit cards, including Dave’s.

Why It’s a Good Alternative:

As one of the most established digital payment platforms, PayPal provides secure money transfers, online payment processing, and even credit options. Unlike Zelle, PayPal offers buyer and seller protection, making it a better choice for online purchases.

Why It’s a Good Alternative:

If you prefer using a mobile wallet, both Apple Cash and Google Pay offer easy money transfers directly from your smartphone. These services allow users to send money through iMessage (Apple Cash) or through Google Pay's built-in P2P feature.

Why They’re Good Alternatives:

Chime, another digital banking platform similar to Dave, offers a "Pay Anyone" feature that lets users send money to non-Chime users instantly. This is a great option for those who frequently transfer funds to friends and family.

Why It’s a Good Alternative:

Each of these alternatives offers unique features, so the best choice depends on your needs. If you prefer instant transfers and a social aspect, Venmo or Cash App might be ideal. For secure and international transactions, PayPal is a strong contender. Apple Cash and Google Pay work best for those integrated into the Apple or Android ecosystems, while Chime’s Pay Anyone feature is useful for those who need a direct Zelle alternative.

By exploring these options, Dave users can still enjoy fast and secure money transfers, even without direct Zelle integration.