Robinhood launched in April of 2013.

Their impact on the investment industry has not been small, they even have a term for it called the “Robinhood Effect."

Robinhood revolutionized the brokerage industry by offering commission-free trading. Almost all other brokerages have followed suit as a result. Robinhood truly transformed the brokerage industry forever.

Their focus on an easy-to-use beginner-friendly platform has drawn in many beginner investors.

Robinhood is the first step in many beginner investors' journeys. With their widespread popularity and simple interface, this is for good reason.

So how does Robinhood work?

Check out my video below to learn more, or keep on reading!

First things first, in order to use Robinhood and see how it works, you will need to sign up for an account here.

Be sure to use our link above, as you will get a free stock worth up to $200! You get to pick your free stock from a list of 20 leading American companies.

Since this is a full-blown brokerage account, Robinhood is required to ask you for certain information such as your employment, social security number and level of investment experience.

Robinhood is required by law to collect this information, and they make it clear that they do not share this information.

During the sign up process, Robinhood will ask you a few questions related to your possible relationships with individuals at publicly traded companies.

All brokerage platforms are required to ask these questions:

Next, Robinhood is going to ask you to answer some required questions about your tax situation.

They will ask you whether or not you are subject to backup withholdings from the IRS.

If you don't owe money to the IRS, this is most likely going to be a "no."

Robinhood is required by law to report your investment activities to the IRS, as you will need to pay taxes on your capital gains, earned interest, dividends and more.

You can read our full article about Robinhood taxes here.

The next step in the sign up process will be linking your bank account in order to deposit funds.

Here's step-by-step instructions on how to do this:

Robinhood gives you a few different options when it comes to funding your new account. You can link up to 3 bank accounts as well as 1 debit card.

The debit card comes with a $1,000 daily deposit limit, however you have the advantage of instant transfers here.

Direct bank account transfers, on the other hand, are expected to take 4 to 5 business days.

At this point, you'll decide whether you want to add a bank account or a debit card. Then, you'll have the option to initiate a transfer once the account is successfully linked.

Time for the fun part! As soon as you fund your account, you'll receive a notification about getting your free reward stock.

Robinhood offers a unique incentive where you are actually able to pick your free stock yourself.

Once your account is funded with any dollar amount, you'll receive a random dollar amount as a reward.

With this reward, you have the exciting opportunity to pick a gift stock from a list of 20 of America's leading companies. These companies are carefully selected based on their market capitalization within their respective sectors.

You can use this reward to claim a fractional share of a stock.

Check out our full article on the Robinhood free stock here to learn more.

In the past, investors would have to purchase a whole share of a stock or ETF in order to gain exposure to the asset.

This became problematic when investing in companies with a high share price, such as Berkshire Hathaway Class A shares. These shares have never been split, and as a result, the share price is over $500,000!

If you wanted to buy shares of this stock, or others with a high share price, Robinhood allows you to invest in $1 increments using fractional shares.

Instead of owning an entire share, you could own as little as 1/1,000,000th of a share.

One of the very next things you might want to do is search for a stock or ETF using the Robinhood app.

Here's my full video tutorial below, or keep on reading!

Here's instructions on how to search for an investment using Robinhood:

After looking for Apple stock, here is what you will see.

Here's some of the key information on this screen:

With time, you'll become more familiar with these various statistics. For now, it's just important to be aware of where you access this information.

So how do you make money with Robinhood? It's actually quite simple.

The first way to make money is through asset appreciation - or the old adage "buy low, sell high." This would mean buying a stock or ETF and then selling it at a later date for a higher price than you paid. While this is easier said than done, it largely comes down to the performance of the overall stock market or the individual company that you own.

The stock market is all about supply and demand. If you own shares of an individual company that is growing revenues at an above-average rate, for example, this could increase the demand for those shares. This would, in turn, drive up the price.

The second way to potentially make money through Robinhood is by earning dividends.

A dividend is a payment that a company gives to its shareholders, usually from its profits. It's a way for the company to share a portion of its earnings with the people who own its stock.

Dividends can be paid in cash or additional shares of stock and are typically given out regularly, such as every quarter (three months).

By purchasing dividend paying stocks or ETFs, you too can make money through these routine payments! It's also possible to make money through both dividends and asset appreciation. An example of this would be purchasing a dividend paying stock that also appreciates in value over time.

If you want to actually purchase a stock, such as Apple, you will click on the green Buy button.

By default, it will be set to dollar value investing - leveraging those fractional shares. However, you can click the drop down menu in the top right if you want to change this to whole shares.

At this point, you will enter the dollar value you want to invest, or the total number of shares you are looking to purchase. If you want to take advantage of fractional shares, you will need to invest using the dollar value.

Once you are ready to move forward, click on the green Review button.

Finally, you will confirm the order if you want to actually place the order.

Let's say some time has passed and you are now looking to sell a stock or ETF that you own in your Robinhood portfolio. Hopefully, you are looking to take some profits!

First of all, let's cover how to tell whether or not you have made money through your Robinhood investment.

On the main home screen of the app, if you scroll down to the Stocks & ETFs section, this will show you what you currently own within your Robinhood portfolio. You'll want to click on whatever stock or ETF you are looking to potentially sell.

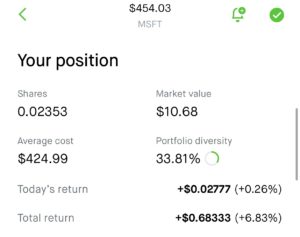

This will bring you to the specific page for that investment. For example, I own a fractional share of Microsoft stock (MSFT) in my demo Robinhood portfolio.

Since purchasing this, my original $10 investment has grown in value to $10.68 - or an overall return of 6.83%.

In order to sell this, or any stock/ETF owned within Robinhood, here are the steps:

Robinhood Gold is a premium subscription service designed for active investors who want access to advanced tools, data, and features to elevate their investing experience. For a monthly fee of $5, Robinhood Gold offers the following powerful benefits for non-retirement, individual, and joint investing accounts:

4%* APY on Uninvested Brokerage Cash: With the cash sweep feature, Robinhood Gold offers a 4% annual percentage yield (APY) on uninvested brokerage cash, helping you earn interest while waiting to make investments. (*Interest Rates are subject to change)

Bigger Instant Deposits: Gold members enjoy larger instant deposit limits, enabling you to access funds more quickly for trading without waiting for traditional bank transfers to clear.

Professional Research from Morningstar: Robinhood Gold provides access to in-depth research and investment analysis from Morningstar, a trusted financial research firm. This helps you make informed decisions with professional-grade insights.

Level II Market Data from Nasdaq: Gold members get access to Level II market data from Nasdaq, which shows real-time bid and ask prices for stocks, giving you a deeper understanding of market trends and liquidity.

Margin Trading: With Robinhood Gold, you can borrow up to $1,000 of margin interest-free. This allows you to amplify your purchasing power for investments, though margin trading involves significant risks.

Management Fee Discount on Robinhood Strategies: Accounts managed by Robinhood Strategies are only charged management fees on the first $100,000 of assets under management, making it a more affordable option for larger portfolios.

IRA Match: If you have a Robinhood IRA, Gold members receive a 3% IRA match on eligible contributions, helping you grow your retirement savings more efficiently. The caveat is you must hold your contributions in Robinhood for at least 5 years to keep the match.

You can try Robinhood Gold with a 30-day free trial.

Since its launch in 2013, Robinhood has continuously expanded its services and evolved to cater to the growing demands of investors seeking commission-free trading.

The platform has successfully positioned itself as a disruptive force in the world of online brokerage services, appealing to both novice investors and more experienced traders. Recently, Robinhood has introduced several new features and services aimed at broadening its user base and enhancing its financial offerings:

In 2025, Robinhood launched Robinhood Strategies, an actively managed robo-advisor service designed to help users build and manage investment portfolios based on their individual goals and risk tolerance. This service is available for an annual fee of 0.25% of assets under management, capped at $250 for Robinhood Gold members.

Robinhood Strategies aims to provide users with a convenient way to access professional portfolio management without the high fees typically associated with traditional wealth management firms.

Robinhood has also expanded into the banking sector with its Robinhood Banking initiative. The platform now offers a range of banking services, including a 4% annual percentage yield (APY) on savings accounts, a robust set of premium features like on-demand cash delivery, and international money transfers.

This development positions Robinhood as a competitor in the growing neobank space, offering a private banking experience to a wider audience at a lower cost.

In an effort to leverage emerging technologies, Robinhood introduced Cortex, an AI-driven investment tool that provides real-time analysis and personalized insights to assist users with their investment decisions.

This service aims to offer actionable, data-driven recommendations tailored to the unique needs of individual investors, enhancing the overall user experience and fostering more informed decision-making. They plan to roll our Cortex in 2025 to Gold members.