When most people begin learning how to invest, the term "index fund" comes up frequently. Index funds can be great investments for certain types of investors, especially those who are just starting out.

In this post, we are going to explain how index funds work and why they may be great investments for many investors depending on their investment style. We will also provide updated examples of popular index funds in 2025 and practical steps to get started.

An index fund is a Mutual Fund or Exchange Traded Fund (ETF) that holds a group of stocks, bonds, or other asset classes. An index fund is tied directly to a market index. Index funds are common investment vehicles because of their simplicity and diversification benefits.

Due to the simplicity of index funds, they typically have lower fees compared to traditional investment vehicles. These lower fees are passed on to index fund investors.

A market index is simply a group of investments—like stocks or bonds—that are bundled together to represent a specific slice of the market. Indexes help investors see how that part of the market is performing over time. Each index follows a set of rules that determine which investments are included, often based on factors like company size, industry, or location.

One of the best-known examples is the S&P 500, which tracks roughly 500 of the largest companies in the United States. It’s market-cap weighted, meaning that bigger companies, like those with higher total stock market values, make up a larger portion of the index.

Another popular example is the Dow Jones Industrial Average, which follows 30 major U.S. companies across a variety of industries. Unlike the S&P 500, it’s price-weighted, so stocks with higher share prices have more influence on the index’s movement.

For bond investors, the Bloomberg U.S. Aggregate Bond Index is a common benchmark. It measures the overall performance of the U.S. investment-grade bond market, including Treasury bonds, corporate bonds, and mortgage-backed securities.

Investors often use these indexes as benchmarks to measure how their own portfolios are performing. If your portfolio performs about the same as the index, you’re essentially matching the market. If it performs better, it means your strategy is outperforming that particular segment of the market.

Beyond the traditional S&P 500 and Dow Jones indexes, there are many index funds available that cover a range of sectors, geographies, and asset types:

There are also specialized index funds that focus on specific factors, commodities, or real estate, giving investors even more ways to diversify beyond traditional stock and bond markets.

Index funds are ETFs or mutual funds that track a market index. By purchasing this ETF or mutual fund, you are virtually buying a basket of underlying stocks or bonds. You can buy and sell index funds actively every day or hold on to them over time.

Many of these funds have small fees you pay as a percentage of your investment. Index funds typically have low fees when compared to actively managed funds because of their simplicity and automated nature.

When you purchase an equity index fund, you own a small piece of each underlying stock. Some of these stocks pay out dividends to investors.

The S&P 500, for example, holds the 500 largest companies in the U.S. Currently, over 80% of these companies pay dividends.

Over time, each of these companies will pay their dividend to the index fund. Then, the index fund itself will have a quarterly dividend payment to the holder of the fund. This allows investors to earn even more interest.

Though not the same as compound interest, dividends share many similarities with compound interest. For more on the topic, check out our article on compound interest here.

One of the most famous investors of our time was heavily involved with the creation and widespread acceptance of index fund investing. His name is Jack Bogle.

Bogle is the founder of The Vanguard Group and has been an advocate for index funds since the 1970s. Bogle was one of the first fund managers to develop mutual funds that directly tracked broad market indexes.

The Vanguard Group is one of the largest asset managers in the world with a total of $7.2 trillion in assets under management. Vanguard was founded on the principles of Jack Bogle. Namely, that investors should earn market returns over time by investing in low-cost broad market index funds.

One of the best books I've read about index fund investing is The Little Book of Common Sense Investing by Jack Bogle. This book explains in detail the power of holding index funds over time. In it, Bogle identifies the savings from choosing low-cost funds and taking a long-term investing approach.

Index funds are a way for investors to gain broad market exposure to a group of stocks or bonds. This makes index funds a great option for investors who want an easy way to diversify their portfolio.

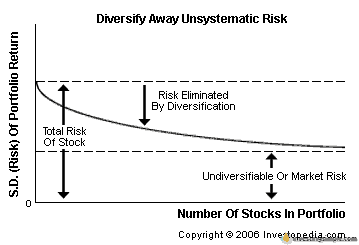

When investors diversify their portfolio and hold a group of stocks rather than just one company, the overall risk of their portfolio decreases significantly.

For example, if you only have $1,000 to invest and you put it all into Facebook stock. It would only take one bad quarter for a significant chunk of your portfolio to disappear. But if you distribute that $1,000 over 500 different companies, it would require a majority of the companies to have a bad quarter in order for your portfolio to decrease in value.

We have all heard the term “don't put your eggs in one basket”. This phrase is very relevant when trying to build a diversified portfolio to mitigate risk.

One of the fundamental theories in finance today is the Modern Portfolio Theory. This theory aims to explain how risk-averse investors can build a well-diversified portfolio to maximize returns given a set level of market risk.

In other words, the theory explains how a well-diversified portfolio of uncorrelated assets can earn greater returns as well as be less volatile over time when compared to individual companies. A common beginner allocation might be 85% stocks and 15% bonds, mixing stock index funds with bond index funds to balance growth and risk.

The image above shows by increasing the number of holdings in your portfolio you can diversify away company-specific risk. As you hold more companies in your portfolio, you are less susceptible to risk from a single stock.

Over time, you reach a point in your portfolio where the only risk you have is broad market risk. Market risk is the overall risk of investing in financial markets. These risks include volatility, political events, changes in interest rates, and recessions. Market risk is a risk that cannot be diversified away.

All portfolios have risk-reward profiles. You can measure these risk-reward profiles by using various metrics and ratios. The risk-reward of holding an individual stock in your portfolio is high because you are putting all your money in that one stock.

Because the risk is high, the potential reward is high as well. That position could go up significantly or it could earn you a negative return. The risk is high because the potential volatility of your portfolio is high.

Now, say your portfolio consists of just one stock and to it, you add another. By adding one more stock to your portfolio, you are reducing the portfolio's volatility. This is because the movement in price between the two stocks has the ability to cancel each other out. This reduced volatility (risk) is at the heart of diversification.

When we invest in an index fund, we are eliminating volatility caused by single stocks. Instead, we are generally investing in the market as a whole. This allows us to earn market returns while eliminating single company risk.

When we decide to invest our money, we have to make the decision of how to manage our portfolio.

Traditionally, there are two types of portfolio management - active and passive. These two types of management are very hotly debated in the investment community.

Personally, I employ both of these strategies. When making the decision of active vs passive investing, we must first define the management styles and get a deeper understanding of how these strategies work.

Active portfolio management is a strategy that tends to be more dynamic. There are many different active management styles, but generally active portfolios tend to be more willing to change.

Active managers aim to beat the market over time. They may pick a benchmark index such as the S&P 500 and try to capture higher returns than the index over time.

An active manager will search for market irregularities and take advantage of events that will impact stock prices.

Political events, earnings releases, economic events, Federal Reserve decisions, or breaking news events are some of the events that an active manager trading equities may try to exploit.

As there are many different active management styles, you cannot paint active management with a broad brush. Warren Buffett is one of the best active managers of all time. His company Berkshire Hathaway earned over 1,000,000% return from 1964 to 2015.

The S&P 500 increased 2,300% over that same time.

Buffett is in the top percentile of active managers that consistently beat the market, and he's the best of the best. Buffett is considered an active manager, though he may buy a position and hold it for decades. Some active managers may hold a position for a few hours. Others may hold a position for years.

Passive portfolio management is a strategy that is passive in nature. The goal of passive management is to earn market returns over time. A passive portfolio manager will aim to earn a return equal to an index, such as the S&P 500.

Passive management does not require a proactive approach or an extensive investment management team. For these reasons, passive investments are often lower in cost for the average investor. Using a buy and hold approach lets index fund investors earn market returns over a period of time.

Passive investors typically believe that there is no use in trying to beat the market because it is nearly impossible. This is why passive investors choose to invest in index funds which will earn market returns over time.

A passive index fund aims to eliminate risks associated with individual stocks, sectors, and human error. The only risk associated with a passive index fund is the broad market risk.

Throughout his life, Jack Bogle has explained using hard data how index funds outperform most active managers over time.

He explains that over 95% of active mutual fund managers fail to beat their benchmark index over time. This remains true in 2025, reinforcing the strength of passive investing strategies.

This is a significant figure and shows just how many investors are chasing returns and falling short of their goal of beating the market. For similar reasons, Warren Buffett recommends that most people simply invest in a low fee index fund that tracks the performance of the S&P 500.

One of the biggest advantages of most index funds is the fee structure. Since index funds do not require a large investment team, they are very low cost.

Saving on fees over the course of years can add up to thousands of dollars in your pocket.

When compared to actively managed funds, this could result in savings amounting to hundreds of thousands of dollars over a person's lifetime.

For certain investors, index funds may hinder their investment strategy.

One of the biggest negatives of index funds is the lack of control you have over your portfolio.

For some investors, this may be a good thing and prevent them from making emotional investment decisions. For other investors who see an emerging opportunity in the market, they will not be able to potentially profit if they are invested in an index fund.

When you invest in an index fund, you give up control of your portfolio and give all the control to the index itself. Your portfolio is virtually built by the index managers themselves. They are the ones who decide which companies to include in the index.

The index managers must decide which companies fall within the index metrics and meet the guidelines of the index. For example, a group of people decide which companies should be added to the Dow 30.

Index funds allow you to diversify your investments. However, some portfolio managers believe they can achieve the same amount of diversification with a fewer number of stocks. These managers typically buy 20, 30, or 40 companies within different sectors and attempt to beat the return of the indexes. Many managers attempt to do this while maintaining broad portfolio diversification.

Other money managers may not believe in portfolio diversification at all. These investors prioritize investment performance over total portfolio risk. This type of active investing can be higher risk.

Another risk when investing in index funds is the misunderstanding of portfolio diversification. An investor who invests their entire portfolio in an index fund within a specific sector would not be considered diversified.

For example, if you allocate a single index fund for semiconductors to your entire portfolio you would have significant exposure to the fluctuations of the semiconductor market.

An S&P 500 index fund on the other hand provides exposure to hundreds of companies across dozens of industries and would provide much more thorough diversification.

It really comes down to your investment style. If you enjoy the researching and valuation of individual companies, then an index fund may not be an ideal choice. Individual stocks can earn high returns but also carry much more risk.

It is important that you understand the risks involved with a single stock before you commit capital to such a volatile investment. If you are a more passive investor and want to protect yourself from self-harm or from choosing bad investments, then index funds may be a great option for you.

If you want to learn more about investing in individual stocks, here is our beginner's guide.

Investing Simple is affiliated with Betterment and M1 Finance.

An investor can purchase an index fund at virtually any online brokerage nowadays, including popular platforms such as Fidelity, Charles Schwab, Vanguard, M1 Finance, and Betterment.

If you are a fee-sensitive investor, M1 Finance offers prebuilt portfolios that will invest your money in low-fee index funds.

M1 Finance does not charge any fees to invest with the platform and they have a minimum balance of $100.

On top of that, you can take advantage of portfolio automation and set up automatic weekly or monthly deposits to regularly invest. Most passive investors do so through a retirement account and M1 Finance offers these for free with a minimum balance of $500.

If you are looking for a little more portfolio guidance, Betterment could be a great option as well. Betterment is a robo-advisor that determines your ideal portfolio allocation through the use of algorithms. In exchange for this, they collect an asset management fee of 0.25%.

This is still extremely low when you compare it to industry peers.

Betterment offers other features such as Smart Saver, automated rebalancing, and tax-loss harvesting. Betterment invests your money in low-fee index funds.

If you want to follow the self-managed approach, you can buy ETFs through any brokerage these days. You can also invest directly into Vanguard funds on the website if you meet the minimum balance requirement.

Index funds offer great opportunities for investors. For the average person, investing in a low-cost index fund may be a great investment decision. Here is a brief overview of index funds:

Over time, index funds have proven to be a strategy that has a higher probability of success when compared to traditional investment strategies. Index funds provide the average Joe with diversification and low fees, making indexing an attractive investment strategy for many investors.

Don't forget to grab your free stock worth up to $200 from Robinhood today!