Warren Buffett is arguably the most successful investor of our time.

Buffett is still the chairman and CEO of Berkshire Hathaway at 91 years old. As of 2022, Warren Buffett has a net worth of $116 billion. Despite being very rich, Warren Buffett is known for being a philanthropist and gives away a lot of his money.

Over the last 15 years, this has amounted to more than $41 billion in donations.

One of the key foundations he contributes to is the Bill and Melinda Gates Foundation, as he has been a long-time friend of Bill.

Despite being one of the richest people in the world, Buffett is known for being very frugal. In fact, he still lives in his Nebraska home that is worth around $650,000 today.

He could obviously afford a much more expensive home, but this is not his concern.

Aside from drinking more Coca Cola than most teenagers do, eating Cheetos, and reading, Warren Buffett is a stock market investor.

As far as his wealth goes, much of his money was made later on in life. Warren Buffett earned most of his money from investing in companies and 99% of his net worth was earned after his 50th birthday.

Millions of stock market investors idolize Warren Buffett, and in this article, we will be exploring 7 ways that you can think and invest like billionaire Warren Buffett.

Despite being friends with Bill Gates, Warren Buffett historically doesn't invest in tech outside of Apple.

Robinhood is a popular "all-in-one" investing app.

While they are most well-known for their commission free stock trading, they've recently shaken up the Retirement Investing World too.

Introducing Robinhood Retirement; home of the biggest IRA match on the market.

Here's what you need to know:

And don't worry, this comes with a Portfolio Builder Tool. You don't have to construct your investment portfolio from scratch if you don't want to.

Lastly, you'll even get a free stock worth up to $200 when you open a new Robinhood account using our link.

Did you hear about Warren Buffett buying weed stocks?

Or getting in on the hottest new cryptocurrency to hit the market?

Probably not.

Warren Buffett is known for investing in simple businesses. He invests in what he understands. Cryptocurrencies and weed stocks would fall short of a lot of Buffett's criteria, but the main point here is that he does not invest in something if he does not understand it. If you want to invest like the man himself, you shouldn't either!

One of the easiest ways to test your understanding of a company is the elevator pitch.

You have 30 seconds (the length of an elevator ride) to explain what that company is doing and why you are investing in it. If you can't, you don't understand what you are investing in. You need to be able to understand what the business does and what they are doing to make money.

If you don't fully understand an investment, you'll be drawn into making poor decisions down the road. If you see your stock price go down and don't understand the reason, you'll be more likely to panic sell at the bottom. On the other hand, if you could see the context around the stock price decline, you might be able to see that the short-term drop in price was nothing to worry about.

Warren Buffett does have some favorites. He invests heavily in banking, insurance, consumer staples, and utilities. All of these businesses are easy to understand!

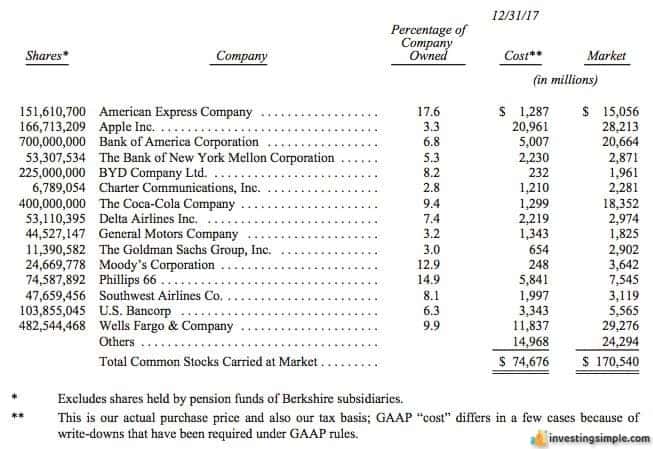

In the annual letter to shareholders, Berkshire Hathaway discloses the largest positions they have in companies.

You can see a common theme here, with Apple being the only stock that sticks out.

Despite shying away from technology and still using a flip phone, Buffett has a sizable position in Apple. Buffett invests in Apple stock because he believes they have extraordinary products that have become an essential part of our everyday lives.

Beyond Apple, we see investments in financial services, banking, telecommunications, food and beverage, airlines, oil, and automotive companies.

One of the other characteristics of companies that Warren Buffett invests in is durability. Buffett invests in durable time tested businesses. He invests in companies that have been around for decades with experience in all market conditions. If you want to invest like Warren Buffett, consider investing in some durable blue-chip stocks.

A great place to start is by looking at stocks on the Dow Jones!

"Price is what you pay. Value is what you get." - Warren Buffett

Warren Buffett is a long-term value investor.

He invests in companies based on the underlying value of the shares. Determining the underlying or intrinsic value of a stock is very difficult, which is why Buffett recommends that most people just invest in low-fee index funds.

These allow investors to track the entire market rather than trying to outperform the market through strategic stock picking. Given that over 90% of those that attempt to beat the market are unsuccessful, index funds seem to be a good bet for most individual investors.

When it comes to investing in stocks, most people only focus on the price of a given stock. They look at market high flyers and try to get in on what is already taking off. However, very few actually take a step back and consider what the value is that they are actually getting.

Value investors do not invest in "hype." They study the fundamentals, comb through financial documents, and buy shares of companies trading at or below their intrinsic value. Most of the market high flyers and tech stocks trade at crazy high valuations that far exceed the value of the company assets.

Warren Buffett is a long-term investor.

He patiently waits for investment opportunities, and once he buys shares he rarely sells them. Some of Buffett's investments date back to the 1960s!

Warren Buffett started buying stock in American Express in 1964.

If you want to invest like Warren Buffett, you need to have a long term mindset when it comes to investing. Buffett does not care about what a company or stock is doing in the short term. He focuses on the long term and looks at what companies will have a long-term competitive advantage over the next decade or more.

Stocks are a long term investment. The movement of the share price in the short term is unpredictable. Trying to bet on what will happen to a stock in the short term is near impossible.

Benjamin Graham, mentor to Warren Buffett, once said that the market is a pendulum, forever swinging between optimism and pessimism.

Warren Buffett learned a lot from Benjamin Graham.

For example, Buffett has said that you should be greedy when others are fearful and fearful when others are greedy. Optimism leads to greed and pessimism leads to fear.

Buying from the pessimist means that you are buying stocks when there is fear in the market, or buying low.

Selling to optimists means that you are selling stocks when there is optimism or euphoria in the market, or selling high.

If you hear everyone talking about a hot stock, it is probably time to sell it.

The underlying value of a stock does not change in the short term, only the price does. At some points, the price is high due to greed and feelings of euphoria. At other points, the price is low due to feelings of fear.

It's our natural human tendency to want to follow the crowd. When we see other people piling into the new hot stock, we don't want to miss out. But then when the stock starts to fall in price and we fear we may have bought in at the top, we sell for a loss. This is the exact opposite of how Warren Buffet invests and is a tendency that you would do well to eliminate.

Most people make money in the stock market through asset appreciation.

You buy shares at a low price and sell them down the road at a higher price. If you want to invest like Warren Buffett, do not buy shares of stocks at all-time highs!

You do not see Warren Buffett investing in the high flyers of the market because it violates (at least) two of his investing principles; price versus value and being greedy when others are fearful.

Stocks are the only thing people are afraid to buy on sale.

If you go to the grocery store and find out Tide laundry detergent is 50% off, you would load up. If Procter & Gamble stock goes on sale, the producer of Tide, people are afraid to buy it! When a company stock goes on sale, you typically have a lot of talking heads on TV telling you to sell. This is actually the time when you would want to buy!

With the stock market, doing what is right often feels wrong.

If you study Warren Buffett, you will also find that he puts little stock in what Wall Street analysts have to say (pun intended).

"We have long felt that the only value of stock forecasters is to make fortune tellers look good." - Warren Buffett

You will not find Warren Buffett glued to the TV on a Monday afternoon looking to catch up on the latest market opinions.

Buffett is likely reading a book in his office. If you want to invest like Warren Buffett, you need to formulate your own opinion surrounding investments. While there is nothing wrong with having a discussion about stocks you own or are watching, you should not be swayed by the opinions of just anyone.

Times of market pessimism are often the best opportunities for investing in the stock market.

One of the easiest ways to invest like Warren Buffett is to invest in his company Berkshire Hathaway.

Berkshire Hathaway is a holding company owned by Warren Buffett. From 1965 to 2017, Berkshire Hathaway stock has had a compounded annual gain of 20.9% per year, compared to a 9.9% return from the S&P 500.

A lot of people are curious about the share price.

The reason why Berkshire Hathaway stock trades at a share price of over $320,000 is that this stock has never been split. When the share price becomes out of reach for most retail investors, a company will often split the shares to make the price more accessible.

Instead of splitting, Berkshire Hathaway instead offers Class B shares under the symbol BRK.B which currently trades at around $215 per share.

While Berkshire Hathaway has an impressive history of beating the S&P 500, you might not want to invest in this stock. The main reason is one that many large investment funds have as well. The larger a fund becomes, the larger the opportunities they need to find.

It is difficult for a company with a market capitalization of over $500 billion and a cash pile of over $100 billion to find new investments.

Small and mid-cap companies are essentially off the table. For Berkshire Hathaway to have a meaningful position in companies this size, they would likely have to own it. This limits investments and acquisitions to just the largest companies out there. For that reason, Buffett has said that it will be more difficult to generate market-beating returns going forward.

Another important factor to remember is that Warren Buffett is 90 years old. If you are looking to invest for the long term, you will need a new strategy or leader once Buffett steps down or passes on.

"Give a man a fish and you feed him for a day. Teach a man to fish and you feed him for a lifetime." - Chinese Proverb

It is much more valuable to know how to invest on your own instead of simply following the strategy of someone else.

Warren Buffett spends a lot of time learning about the management team of a company.

A good management team is a characteristic of any company Buffett invests in. Buffett looks at how management treats shareholders, employees, customers, and even the environment. Above all else, he looks for management to be honest with the shareholders.

Buffet looks at a number of factors including share buybacks, dividends, dividend growth, and the overall company reputation.

If management is acting responsibly, dividends should be paid on a regular basis with a long history of consistently raising that dividend. Shareholders should also be rewarded through a company-sponsored share buyback program.

If you want to invest like Warren Buffett, get to know the management. Read the annual reports, earnings reports, watch interviews, and study the career path of the company management team.

Do they have an outside hire? Where did they work before?

Now while this might not seem like the most exciting idea to many investors, it's the work that you put in beyond what other investors are willing to do that is going to give you the leg up.

If you're not willing to take the time to dig deep into companies you are considering investing in, your best bet is probably going to be sticking to Buffet's two fund portfolio.

If Warren Buffett hadn't made a career of picking stocks, how would he have invested?

Luckily for us, Buffett has answered that question.

In a letter to shareholders, he outlined a retirement plan that anyone could implement with ease. It does not involve diligent research and stock picking. It involves investing in two funds.

That's it. Warren Buffett recommends investing 90% of your money in the S&P 500 fund and the remaining 10% in a government bond fund. As far as funds go, Warren Buffett recommends Vanguard products for good reason. They are known for having extremely low fees and wonderful financial products.

For the low fee S&P 500 index fund, the Vanguard 500 Fund is an excellent choice. Vanguard also offers bond funds. A suitable choice would be the Vanguard Short Term Treasury Fund.

You can buy that fund here on M1 Finance commission-free.

Instead of trying to beat the market, Buffett believes the average investor should own the entire market. It is important to remember that this portfolio is very broad and it is not specific to any person's individual needs.

If you are looking for a long term investing plan, you should consider speaking with a financial advisor. Even just an initial conversation with someone who does this for a living is likely to be quite informative.

Instead, if you want to pick stocks and invest like Warren Buffett, follow these strategies! If you want to follow Warren Buffett's investment advice, go for the two fund portfolio. At the end of the day, the most important thing is that you are investing!

Here are some other ways that you can invest like Warren Buffett:

Buffett likes to invest in companies with a durable competitive advantage, and this is often referred to as the moat.

A few examples of what this moat could be are:

Consider Apple for example. This company has a massive moat, as it has numerous barriers to entry. Apple has countless patents and technologies that are proprietary to their company. They also have a network effect, since so many people use the product. They also have economies of scale working for them since they are producing so many pieces of technology.

Lastly, consider the start-up costs required to start a company like Apple. They have factories all over the world as well as thousands of stores.

When doing your research on a company, consider what their moat is before investing. You will find that some companies have a large moat while others do not.

Warren is notorious for mocking Wall Street analysts.

In one of his most famous quotes, he says "We've long felt that the only value of stock forecasters is to make fortune-tellers look good."

Essentially, what he is getting at here is that what these analysts say about markets and companies should be taken as seriously as a fortune from a fortune teller. So, you don't see Warren Buffett buying and selling stocks based on these market forecasters. He conducts his own research and sticks to his strategy.

It can be difficult to formulate educated opinions when you are just getting started, but that's why you need to put in the work to learn about investing. Buffet has spent decades honing his craft and building his knowledge so that he can make educated opinions. Don't expect to be able to do the same right off the bat.

It is common to discuss stocks socially with friends and family.

Now he has never outright said that you should not follow stock tips from others, but we can deduce that he does not recommend this from his other core investing principles.

Following a hot stock tip from a friend violates a few of his principles, such as investing in what you know. Odds are, you are not an expert in whatever this asset is that someone is recommending to you.

The other problem with stock tips is that this is not a sustainable strategy. If you simply wait for someone to share a hot tip with you, how are you going to repeat this over time? Are you just going to hang around the bar waiting to overhear some conversation from strangers?

You are much better off having your own investment strategy that does not rely on the input of others.

One of the biggest mistakes investors make early on is getting their emotions involved.

Making money and losing money are two very powerful emotional drivers. Long term investors do not pay attention to the day to day price movements of the companies that they own. Instead, they focus on the long term picture.

You want to avoid making emotional decisions as an investor. Often times, we make the worst decisions when acting on impulse.

This is actually why Buffett recommends being greedy when others are being fearful. People are being irrational and selling quality companies at rock bottom prices. This is the time to take advantage of that pessimism in the market and score yourself a deal.

So if you find yourself glued to your Robinhood app all day watching your portfolio go up and down in value, you're likely not doing yourself any favors. Instead, know that the companies you are invested in are investments for the long term and don't get wrapped up in short-term price fluctuations.

Just like anything else out there, investing is a journey. Even the greatest investors of all time make mistakes. Recently, Warren Buffett sold off his entire airline position after the global pandemic caused by COVID-19. He lost millions of dollars on this investment.

An investment in the airlines fit a lot of Buffett's criteria, but a global pandemic that shut down travel was something that nobody could predict.

The point here is, you will make mistakes just like Warren Buffett does even today. You simply have to learn from these mistakes and find different ways to improve.

If the idea of reading balance sheets and studying annual reports puts you to sleep, individual stock investing might not be for you. You might be better off following the index fund investing approach that Buffett recommends.

If you do plan on entering the world of individual stock investing, consider these strategies, and try implementing some of them yourself!

Don't forget to grab your free stock worth up to $200 from Robinhood today!