Investing in the S&P 500 index can be a great way to gain exposure to a broad range of well established US companies. And with Robinhood, it's easier than ever to invest in the S&P 500 through an ETF.

In this article, we'll walk you through the steps to invest in the S&P 500 using Robinhood.

Since they offer a user friendly app and commission free trades on stocks and ETFs, many investors prefer using the Robinhood app.

You can also set up a recurring investment if you wanted to invest in the S&P 500 on a set schedule. This can be helpful, as it deploys a strategy called Dollar Cost Averaging which we will cover shortly.

If you're looking for a step by step tutorial, check out my video below! (Skip ahead to 7:21 for the Robinhood S&P 500 investing tutorial.)

The Standard & Poor’s 500 Index is a market value weighted index of the 500 largest publicly traded companies in the United States.

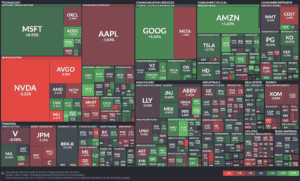

Market value weighted simply means that the larger a company is, the more weight it will carry in the index. So when you invest, a large portion of your money goes into stocks like Microsoft, Apple, NVIDIA, Amazon and Meta.

This is because of how big and valuable these companies are already. For example, Apple is the most valuable public company in the US right now. Their total market value (or Market Capitalization) is $3.17 Trillion as of March 14th, 2025.

Finviz has a heat map that shows you a visual of this in action - the larger the square is, the more of your money gets allocated there.

Now the S&P 500 was launched in 1957, which predates many of the companies that are included in the index today. To adjust for this, the 500 companies included within the index change over time - based on what US companies are the most valuable.

This video by RankingCharts shows how the top 10 most valuable companies have changed over time from 1979 to 2021. The S&P 500 adjusts over time to account for this.

So why do people invest in the S&P 500?

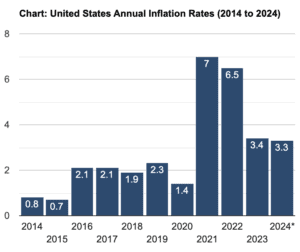

Well the very reason for investing in the first place is to protect your buying power from inflation as well as grow the value of your money.

Inflation has historically been around 2% annually, but since the pandemic and the stimulus money that entered the economy, it has been elevated. This makes investing all the more important, as idle cash is losing purchasing power at a faster rate than it has in the last 40 years or so.

In addition, the S&P 500 provides you with broad diversification across a large portion of the US economy. When you invest in this index, your money is spread out across all of these different sectors and industries.

This gives you exposure to all different segments of the US economy. If one particular company or segment takes a nosedive, the rest of what you own will help to offset that.

You also have the benefit of being able to follow a “set it and forget it” approach. You can fully automate this investing strategy, and then spend your time doing the things you enjoy.

Lastly, even Warren Buffett himself has said "In my view, for most people, the best thing to do is own the S&P 500 index fund." when discussing that he has only met a small handful of people able to beat the S&P over their investing career.

Considering the S&P has returned about 10% per year for nearly 100 years, that's solid advice!

Investors looking to gain exposure to the S&P 500 often turn to exchange-traded funds (ETFs) that track the index. The most popular options include:

While all three ETFs track the S&P 500 index closely, factors like liquidity, expense ratios, dividend policies, and tracking differences may influence an investor’s choice.

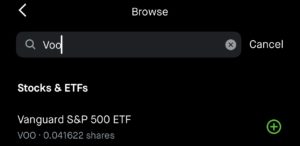

For this example, we will be using the Vanguard S&P 500 ETF which trades under the symbol "VOO."

An ETF is simply an index fund that is split up into shares that then trade on an exchange just like a stock. And an index fund is a basket of stocks designed to track an underlying index as closely as possible. In this case, the index would be the S&P 500.

ETFs makes things a lot more flexible, allowing you to buy individual shares - and through Robinhood you can even buy fractional shares.

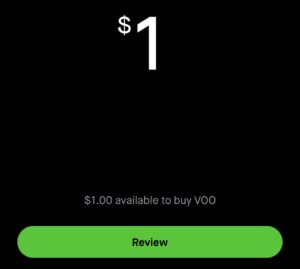

The minimum purchase amount for a fractional share on Robinhood is $1, so that means you can literally invest a buck into the S&P 500 using VOO.

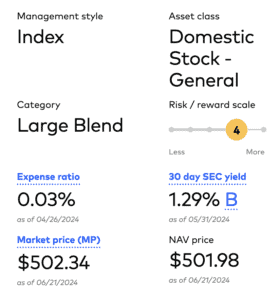

Now every fund out there has an expense ratio associated with it, and this fee is used to pay the fund managers as well as other administrative costs.

The good thing about Vanguard is they have some of the most competitive fees in the industry.

For VOO - that expense ratio comes in at 0.03% (which could change in the future) compared to an industry average of 0.79% as an expense ratio. The expense ratio is deducted from the fund’s returns, meaning you won’t see a separate charge for it—it’s built into the performance of the ETF.

That means if you invested $10,000 into VOO, you would pay $3 in annual expenses to Vanguard. This fee comes out of the fund itself, so you don’t have to pay it separately or anything like that.

VOO’s dividend yield fluctuates based on share price and quarterly dividend payments. Over the last 30 days, it has averaged 1.19%, but this rate is subject to change.

Investors should consider reinvesting these dividends in order to maximize return potential. This can be accomplished through a DRIP or dividend reinvestment program. We'll be showing you how to do this using Robinhood shortly.

Now, let's dive into the steps to invest in the S&P 500 using Robinhood.

The first step is to open a Robinhood account. Be sure to sign up through our link here to get a free stock worth up to $200 when you create a new account!

This Robinhood free stock will be a fractional share worth between $5 and $200, and you actually get to pick your free stock from a list of 20 leading American companies.

Once you've opened your account, you can move on to the next step which will take place within the Robinhood app.

The next step is going to be locating the Vanguard S&P 500 ETF within the Robinhood app.

Here's how to do that:

Once you are on the designated screen for VOO, the next step is to open the trade window.

Here's how:

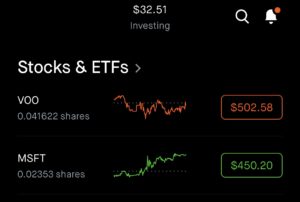

Once you've made your investment into the S&P 500 using Robinhood, you can track your investment performance within the app.

All you have to do is click on VOO from the list of investments within your Robinhood portfolio.

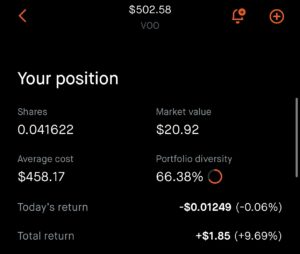

From here, you can scroll down on the ETF page to view your investment performance.

This will be below the section labeled Your position.

For example, this fractional share investment I made into the S&P 500 through the Vanguard ETF has experienced a total return of 9.69%.

The S&P 500 goes up and down, but over the long run, it has a long history of generating positive returns. Your best bet is to ride out the bad times in the short term if the market drops, as it's really the long-term performance that matters.

Robinhood offers a recurring investment option for those looking to invest a set amount of money on a recurring schedule. This can be helpful with long-term ETF investing, as it allows you to deploy a popular strategy called dollar cost averaging.

Dollar-cost averaging (DCA) is a simple investment strategy where you invest a fixed amount of money at regular intervals, regardless of the price of the investment.

By spreading your investments over time, you reduce the risk of investing a large amount of money at the wrong time. In addition, you don’t have to worry about timing the market or deciding the best time to invest.

Dollar-cost averaging allows you to pay the market average for shares over time.

Let's say you were investing $100 a month on a recurring schedule. This would be following the strategy of dollar cost averaging.

Here's what this might look like:

Over three months, you’ve invested $300 and purchased 30.83 shares. The average cost per share would be approximately $9.73.

If you had instead invested all $300 at once when the price was $12 per share, your average cost per share would be $12.

This is a prime example of how dollar cost averaging can help you lower your average cost per share (or cost basis) over time.

Many investors choose to reinvest dividends through a Dividend Reinvestment Plan (DRIP) to maximize their long-term returns.

Benefits of DRIP include:

Most major brokerages (including Robinhood) offer automatic dividend reinvestment options, making it easy for investors to compound their returns without manual intervention.

If you want to put the strategy of dollar cost averaging and DRIP into action, you can do so using the recurring investment and DRIP feature within Robinhood.

Here's how to set it up:

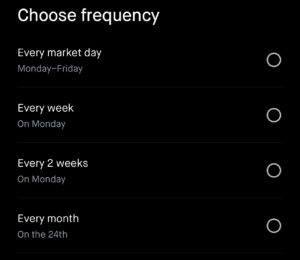

This will allow you to choose the frequency that you invest the dollar amount you specify into VOO. The options are every market day, weekly, every 2 weeks or every month.

Orders will automatically be placed on your behalf between 11 am EST and market close.

Simply go to Account → Menu (3 bars) → Investing an in the Dividend Reinvestment section, select Enable Dividend Reinvestment.

While investing in the S&P 500 can be a great long-term strategy, there are a few common pitfalls to watch out for.

One of the biggest mistakes investors make is panic selling during market downturns. The S&P 500 has seen multiple bear markets and crashes, but over the long run, it has historically recovered and continued to grow.

While short-term losses can be unsettling, selling during a downturn locks in losses and prevents you from benefiting from the market’s eventual rebound.

Instead of fearing downturns, consider viewing them as buying opportunities. When stock prices drop, you can accumulate more shares at lower prices, improving your long-term returns.

Not all S&P 500 ETFs are created equal. While low-cost ETFs like Vanguard’s VOO (0.03% expense ratio) help maximize returns, some funds come with higher management fees that eat into your gains over time.

Always compare expense ratios and trading costs before choosing an investment, as these fees can significantly impact your returns over decades.

By keeping these pitfalls in mind and maintaining a disciplined investing approach, you’ll be better positioned to build wealth through the S&P 500 while avoiding costly mistakes.

You now know how to invest as little as $1 into the S&P 500 using the Robinhood trading app.

Don't forget to use our link when you sign up to get your free stock worth up to $200 today.

Happy investing!