With the advent of digital wallets and online banking services, transferring money between various platforms has become more accessible than ever.

Apple Pay and Chime are two platforms that have revolutionized how we manage our finances.

This article will guide you on seamlessly transferring funds from Apple Pay to Chime, providing step-by-step instructions.

Robinhood is a popular "all-in-one" investing app.

While they are most well-known for their commission free stock trading, they've recently shaken up the Retirement Investing World too.

Introducing Robinhood Retirement; home of the biggest IRA match on the market.

Here's what you need to know:

And don't worry, this comes with a Portfolio Builder Tool. You don't have to construct your investment portfolio from scratch if you don't want to.

Lastly, you'll even get a free stock worth up to $200 when you open a new Robinhood account using our link.

Before transferring funds, you need to connect your Chime account to Apple Pay.

Here's how to do this.

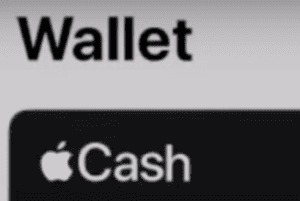

Look for an app that looks like this on your iPhone.

Open this app.

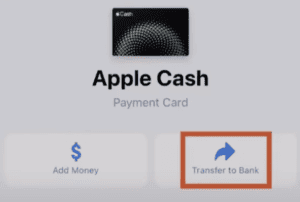

From here, you will need to tap on the Apple Cash card.

Look for a card that looks like the above.

From here, click on the three dots on the top right corner to open the menu for your Apple Cash balance.

From here, select the option to transfer your funds to the bank.

This will prompt you to add a new bank account via debit card or by linking your bank account directly.

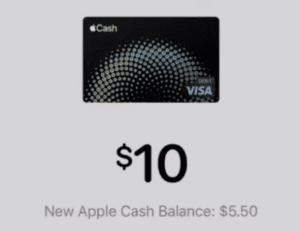

At this point, you can enter the dollar amount you want to transfer from Apple Pay to your Chime debit card or bank account.

Your "New Apple Cash Balance" will reflect the new balance you will have after initiating the transfer.

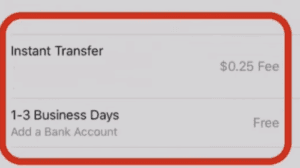

Depending on how soon you need the funds, you can transfer funds instantaneously. Or, you can opt for the standard 1 to 3 business day transfer.

Make sure to consider any fees associated with the instant transfer.