If you're looking to move your investments from Charles Schwab to Interactive Brokers, you've come to the right place.

In this article, we'll walk you through the steps to transfer your assets without the need to sell your stocks or ETFs and move to cash.

It's important to be aware of any associated fees when transferring your assets from Charles Schwab to Interactive Brokers.

Charles Schwab does charge $50 for a full account transfer and $25 for a partial account transfer.

Check out my video on how to transfer your brokerage account below, let's dive in!

Interactive Brokers is a popular brokerage firm known for its advanced trading tools, a wide range of investment products, and competitive fees.

Whether you're an experienced trader or a novice investor, Interactive Brokers offers a platform with many options.

Learn more about Interactive Brokers here!

If you don't already have an Interactive Brokers account, the first step is to open one.

Visit the Interactive Brokers website and follow their account opening process, which typically includes providing personal information.

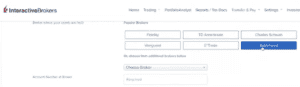

In the dropdown menu that appears under "Transfer & Pay," select "Transfer Positions."

This is the option you'll use to initiate the transfer of your assets from Charles Schwab.

In the next window, you'll see a list of popular brokers.

If you don't find Schwab listed, use the drop-down menu to access more options.

To proceed with the transfer, you'll need to provide your Charles Schwab account number. You can find this information on your Charles Schwab account statements.

Ensure that the account number you input is accurate, as any discrepancies may cause delays in the transfer process. After entering your Charles Schwab account number and reviewing the fees, follow the prompts to complete the transfer request.

This may involve providing additional information and confirming your intention to transfer your assets.

Once you've initiated the transfer, both Interactive Brokers and Charles Schwab will work together to ensure a smooth transition of your assets.

When transferring assets from Charles Schwab to Interactive Brokers (IBKR), it's essential to understand the expected timeline:

Transfer Duration: Typically, an Automated Customer Account Transfer Service (ACATS) transfer takes between 5 to 7 business days to complete. However, certain factors can extend this period.

Cost Basis Information: After the assets have been transferred, the cost basis information (which is crucial for tax reporting) may take additional time to update in your IBKR account. Some users have reported that this process can take up to 15 business days.

The good news is you'll receive notifications and updates throughout the process.

While you typically will not incur any tax issues when merely transferring money between accounts, you should still know how a transfer might look to the IRS.

In-Kind Transfers: Moving your investments "in-kind" means transferring them as they are, without liquidating. This method does not trigger a taxable event, as you're not selling any assets.

Liquidating Assets: If you choose to sell your investments before transferring and then move cash to IBKR, this may result in taxable events, especially if the assets are held in a taxable account.

Odds are, you've already decided to move your money if you're reading this, but let's take a look at the two brokers to make sure this is the move you want to make.

| Charles Schwab | Interactive Brokers (IBKR) | |

|---|---|---|

| Account Types | - Individual and Joint - Retirement Accounts (e.g., Traditional IRA, Roth IRA)- Custodial Accounts- Trust Accounts- Institutional Accounts | - Individual and Joint - Retirement Accounts- Trust Accounts- Institutional Accounts- Margin Accounts |

| Commissions & Fees | - $0 commissions on online U.S. stock and ETF trades - Options trades: $0.65 per contract- No account maintenance fees- No minimum balance required | - $0 commissions on U.S. stock trades - Options trades: $0.65 per contract- No account maintenance fees- No minimum balance required- Competitive margin rates |

| Trading Platforms | - thinkorswim®: User-friendly platform with customizable tools

- Mobile App: Comprehensive features suitable for beginners and long-term investors | - Trader Workstation (TWS): Advanced platform with sophisticated tools for experienced traders - Client Portal: Simplified interface for casual investors- Mobile App: Robust features catering to active traders and investors alike |

| Investment Options | - Stocks, ETFs, Options, Mutual Funds, Bonds, Futures, Forex - Access to IPOs and International Markets | - Stocks, ETFs, Options, Mutual Funds, Bonds, Futures, Forex, CFDs - Extensive access to global markets across 150 markets in 33 countries |

| Customer Support | - 24/7 customer service via phone, chat, and email - Extensive network of physical branches for in-person support | - Customer service via phone and email during market hours - Limited physical branches; primarily online support |

| Research & Education | - Comprehensive educational resources including articles, webinars, and workshops - Robust research tools and third-party reports | - Extensive research tools with advanced analytics - Educational resources tailored for advanced traders |

| Margin Rates | - Higher margin rates compared to IBKR | - Lower margin rates, making it cost-effective for margin traders |

| International Trading | - Limited direct access to international markets; primarily through ADRs and mutual funds | - Direct access to a wide range of international markets, suitable for investors seeking global diversification |

Note: Features and fees are subject to change. It's advisable to consult the respective brokerage's official website or contact their customer service for the most current information.