Are you looking to cash out some of your cryptocurrency investments from Coinbase and transfer the funds to your bank account?

With Coinbase, the process of withdrawing funds is straightforward.

However, it's important to note that it may take some time for the funds to become available for withdrawal due to the settlement process.

In this article, we will guide you through the steps on how to withdraw funds from Coinbase to your bank account. We'll also be explaining the fund settlement process.

New to the world of cryptocurrencies? Check out my full Coinbase tutorial video below!

Let's dive in.

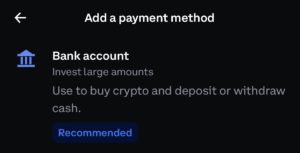

In order to withdraw funds from Coinbase, you'll need a linked bank account. You can skip ahead to the next step if you've already done this before.

If you haven't linked an account yet, here's how to link a bank account.

Open your Coinbase app, and follow these steps:

After signing in with Plaid, your bank account will be linked and verified.

Start by logging into your Coinbase account using your username and password.

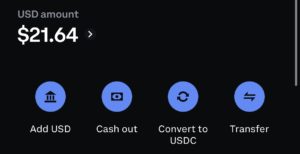

Once you are logged in, navigate to the "My Assets" section using the bottom menu.

In the "My Assets" section, you will see a list of your cryptocurrency holdings and their respective balances.

Locate your local currency balance, which is the currency you want to withdraw to your bank account (USD, EUR, GBP).

Below your local currency balance, you'll see a "Cash out" option.

Click on it to initiate the withdrawal process.

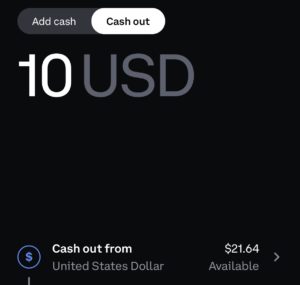

On the next screen, enter the amount of the currency you wish to withdraw to your bank account.

You will be prompted to select a destination for your withdrawal.

Choose the bank account where you want to receive the funds.

Before finalizing the withdrawal, review all the details. Once you have reviewed and confirmed all the details, click the "Withdraw cash" button to complete the transfer.

Coinbase will initiate the process of transferring your funds from your Coinbase account to your chosen bank account.

When withdrawing funds from Coinbase to your bank account, it’s important to understand the fees and processing times involved. Depending on your chosen withdrawal method, the cost and speed of your transaction may vary.

If you're withdrawing funds using an ACH bank transfer, the good news is that there are no fees for this method. However, it typically takes 3–5 business days for the transaction to process. If you’re in no rush and want to avoid extra fees, ACH is a solid choice.

For more details, check out Coinbase’s official support page on ACH withdrawals.

Need your money right away? Coinbase offers instant cashouts to linked Visa Fast Funds or MasterCard Send-enabled cards. These transactions typically complete within 30 minutes, but in some cases, it can take up to 24 hours, depending on your bank or card provider.

While this method is faster, it does come with a fee, which can range from 1.5% to 2% of the transaction amount. If you're okay with paying a small premium for speed, this might be your best option.

You can read more about instant cashouts on Coinbase.

Coinbase imposes withdrawal limits based on your account verification status, region, and withdrawal method. Let’s break it down.

If you’re withdrawing fiat currency (USD, EUR, GBP, etc.), your default daily withdrawal limit is $100,000. However, if you need to withdraw more, you can request a limit increase through your account settings.

You can find more details on Coinbase’s withdrawal limits here.

Crypto withdrawals also have minimum and maximum limits, depending on the specific asset. Here are a couple of examples:

If you’re dealing with a different cryptocurrency, you can find your specific withdrawal limits on Coinbase’s API or their support pages.

To find the minimum withdrawal amount for a specific asset, visit the Coinbase API link and replace "ETH" with the desired asset's ticker symbol. For example, for Ethereum (ETH), use:

https://api.exchange.coinbase.com/currencies/ETH

This will display the minimum withdrawal amount for ETH.