For those considering a move from E*TRADE to TD Ameritrade, the process is designed to be quick and hassle-free.

This article will walk you through the straightforward steps involved in transferring your account.

Check out my video on how to transfer your brokerage account below, let's dive in!

Robinhood is a popular "all-in-one" investing app.

While they are most well-known for their commission free stock trading, they've recently shaken up the Retirement Investing World too.

Introducing Robinhood Retirement; home of the biggest IRA match on the market.

Here's what you need to know:

And don't worry, this comes with a Portfolio Builder Tool. You don't have to construct your investment portfolio from scratch if you don't want to.

Lastly, you'll even get a free stock worth up to $200 when you open a new Robinhood account using our link.

The first step in the transfer process is to open your new TD Ameritrade account. This can be easily done through the online application.

Ensure that the information provided during the account opening process matches the details of your E*TRADE account precisely.

For example, if you are transferring an individual brokerage account, make sure that is the type of account you open.

Once your TD Ameritrade account is open, log in and navigate to the "My Account" section.

From there, select "Account Transfer."

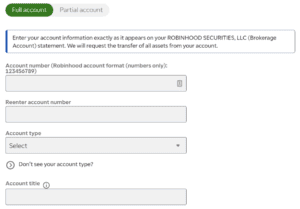

This will initiate the steps for an account transfer from an outside financial institution.

To facilitate a smooth transfer, ensure that the name(s) on the account being transferred from E*TRADE match those on the receiving TD Ameritrade account.

After the transfer is complete, TD Ameritrade allows you to make adjustments to your account. This includes the option to add or remove account owners on your TD Ameritrade account.

From here, you will now fully manage the assets you had in E*TRADE through TD now - assuming you did a full account transfer.