There comes a time when many decide to transfer out of one brokerage account and into another.

In this guide, we'll walk you through the process of transferring your stocks from Fidelity to TD Ameritrade, ensuring a smooth transition.

Check out my video on how to transfer your brokerage account below, let's dive in!

The easiest and quickest method to transfer your Fidelity brokerage or retirement account to TD Ameritrade is by utilizing the ACAT system.

ACAT, or Automated Customer Account Transfer, is an electronic service designed to seamlessly move securities between brokerage accounts. This method eliminates the need for physical paperwork, making the transfer process efficient.

In addition, this allows you to transfer your assets "in kind," meaning you will most likely be able to avoid a taxable event such as selling.

Fidelity supports outbound ACAT transfers, and they don't charge any fees for this. This is great, because some platforms charge a fee as high as $100 for this!

You can transfer stocks, options, ETFs and other assets into your TD Ameritrade account from another firm.

If you have assets outside of these, you might want to sell them off first. Be sure to consider the tax consequences first.

The process is simple from the TD Ameritrade platform:

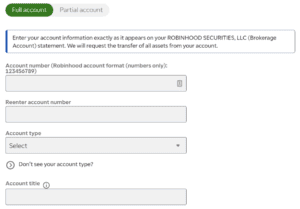

To initiate the transfer, you'll need to provide your Fidelity account number.

You can find this information on your Fidelity account statements.

Here's how to retrieve a copy of your most recent Fidelity statement:

Finally, initiate the ACATS transfer within TD Ameritrade.

🔒 Important: Once the transfer begins, Fidelity will restrict your account — you won’t be able to place trades or withdraw funds until it’s completed.

The standard time period it takes for the transfer into your new TD Ameritrade account is about a week.

Once the transfer process begins, your Fidelity account will be restricted from placing new trades.

Once your assets have landed in your TD Ameritrade account, take a few moments to wrap things up properly:

That's it! You've completed the transfer steps.

Just to cover a few more common questions, ACATS transfers are non-taxable events when done correctly. This is because you can transfer your assets "in kind" without selling them.

In addition, you can transfer other account types like retirement accounts, but the account types must match: (Roth IRA → Roth IRA).

Lastly, most cost basis information will transfer, but double-check once the process is complete. You can always reach out to customer service if there are any discrepancies!